Municipal Finance Authority of BC ($38.5 Million in Revenue)

Summary

Established in 1970, the Municipal Finance Authority of BC (“MFA BC”) was created to provide low-cost financing to municipalities across the province. As per the most recent S&P Global Ratings report: “The authority, unlike peer public sector funding agencies, has taxing powers. MFABC has the unfettered ability to impose a provincewide levy on all taxable land and improvements to replenish its DRF, if needed.” Today, the credit rating of MFA BC is ‘AAA’, while the Province of British Columbia is now ‘A+’.

Problem

MFA BC is a not-for-profit, tax-exempt corporation without share capital controlled by its member municipalities. While the Authority has fulfilled this mandate, it has also accumulated significant untaxed cash reserves and investment assets (see below).

Solution(s)

1: End tax exemption.

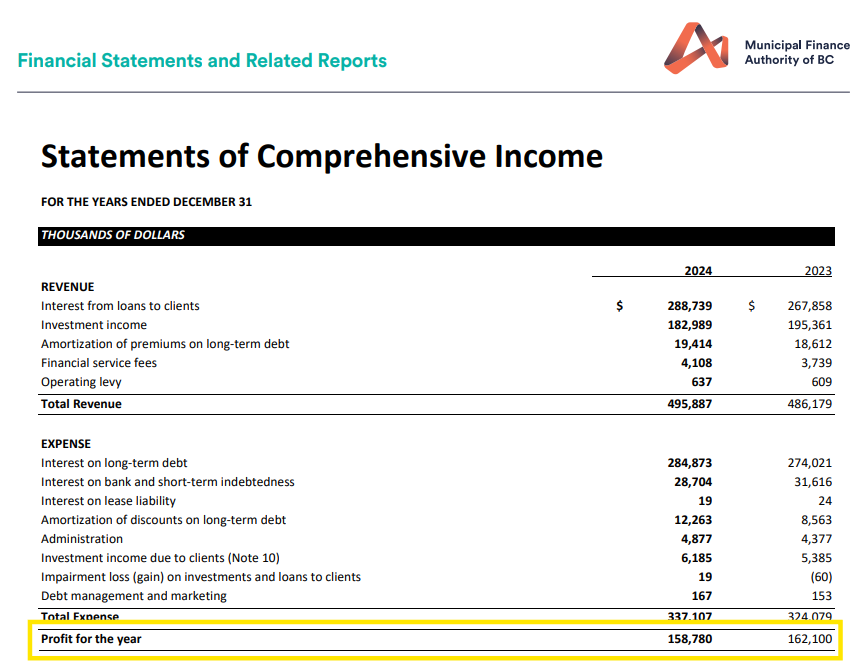

Assuming a 12% provincial corporate tax rate, MFA BC would have paid a total of $38.5 million to the Province of BC in the past two years.

and

2: Mandate greater financial transparency.

Example: MFA BC has 19 employees listed on their website, whose combined annual income was $4.9 million in 2024. This is the equivalent to $256,684/year per employee.